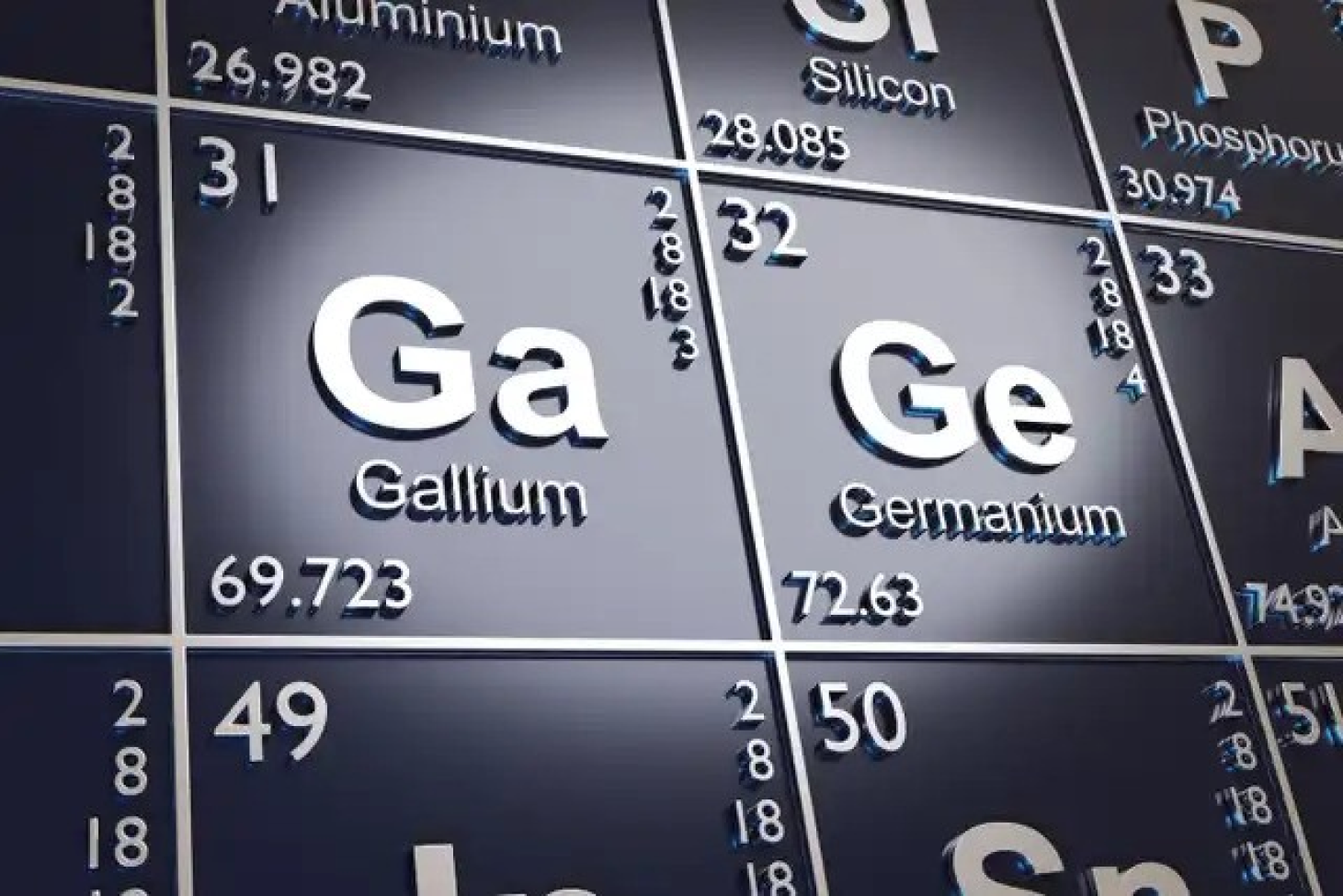

China imposed strict export controls on two key semiconductor materials,

germanium and gallium, in 2023, a move that has since reverberated across

global markets.

These semiconductor materials are critical to the

production of advanced processing chips and military optical hardware, leading

to potential shortages in chipmaking capacity, with prices for germanium and

gallium reported to have nearly doubled in Europe over the past year.

The

Chinese government introduced the restrictions in response to controls imposed

by the US on the sale of advanced chips and chipmaking equipment to China,

citing "national security and interests". China is known to play a major role

in the supply of these semiconductors, producing 98% of the world's gallium

and 60% of its germanium, which shows how reliant Western industries are on

Chinese exports of these semiconductors.

Since the implementation

of the controls, the availability of these materials outside China has been

sharply reduced. Gallium exports, for example, have fallen by about half. A

senior executive at Tradium admitted that the amount of gallium and germanium

obtained through China's new export licensing program is "a fraction of what

we have purchased in the past."

Export controls complicate already

challenging markets, and ongoing restrictions could disrupt the production of

a wide range of goods from fiber optics to night vision goggles. As a result,

long-term supply contracts are now almost impossible to obtain due to the

uncertainties involved, with shipment approvals taking 30 to 80 days.

In

response to these challenges, efforts are underway to increase local

production and find alternative sources for these critical minerals. For

example, Greece's Mytilineos is considering a gallium mining project to meet

EU demand within 18 months. Nyrstar, a Belgium-based zinc producer, is

exploring potential projects to recover gallium and germanium in Europe.

In

addition, in certain applications, gallium can be replaced by silicon or

indium, while zinc selenide can replace germanium. Additionally, recycling

initiatives are being considered to recover these metals from scrap, although

the scale of recycling is currently limited. However, these alternative routes

come at a significant cost, with the supply chain costing around $20 billion

and the effort spanning many years.